Case Study

Safeception in Banking

In a competitive, regulated market, adopting GRC for banks is essential to manage risks, ensure compliance, and drive operational efficiency. Robust risk management in banking enables financial institutions to stay ahead and thrive.

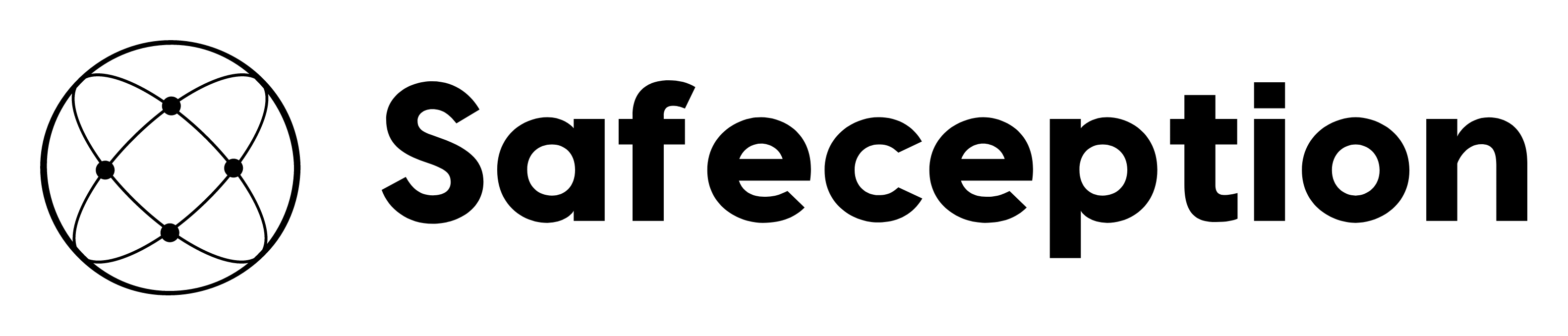

Regulatory Compliance and Data Management

The bank struggled with managing complex regulatory requirements such as GDPR, Basel III and PCI DSS, especially with fragmented systems like CRM and core banking platforms. This siloed approach made it challenging to maintain a unified risk view, increasing the potential for compliance lapses and hefty fines due to missed regulatory deadlines or data handling errors.

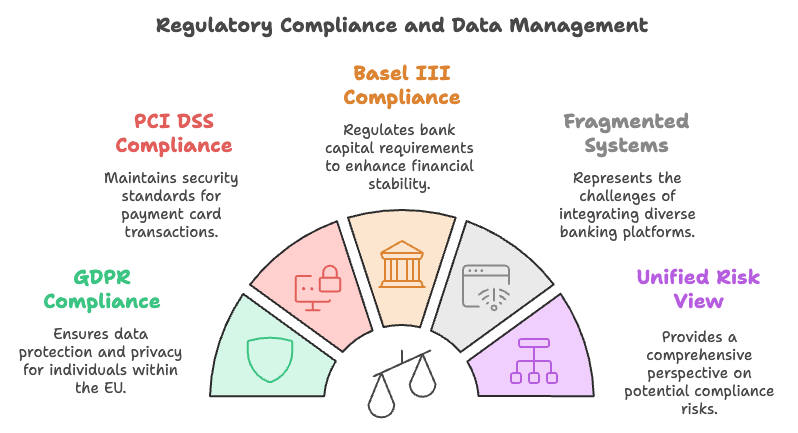

Cybersecurity and Operational Risks

With outdated legacy systems, the bank faced significant cybersecurity vulnerabilities. In 2022, several security incidents exposed sensitive customer information, underlining the need for robust protection. Frequent system outages also disrupted services, resulting in negative customer experiences and financial losses, which impacted the bank’s reputation and operational agility.

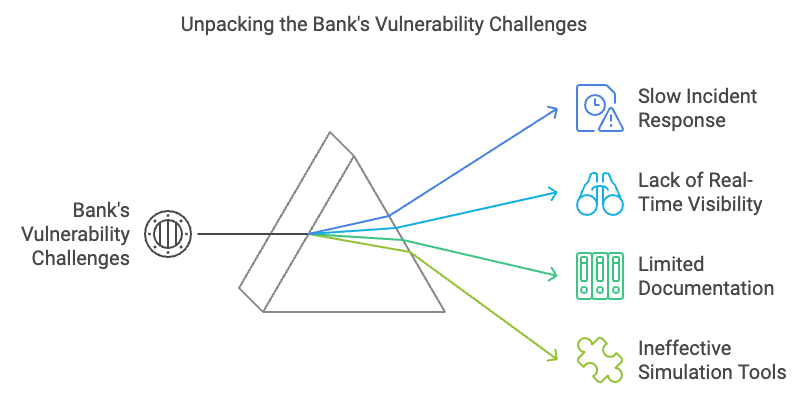

Inefficient Incident Response and Business Continuity

The bank’s slow incident response, compounded by a lack of real-time visibility into vulnerabilities, made it difficult to address threats promptly. With limited documentation on past incidents, identifying patterns or root causes was a struggle. Furthermore, the bank’s business continuity plan (BCP) lacked effective simulation tools, leaving it unprepared for disruptions, risking both financial losses and reputational damage in the event of service outages.

“Since adopting Safeception, our approach to business continuity has transformed. The platform has unveiled potential risks that were previously invisible, helping us better understand vulnerabilities across our operations. With Safeception’s organized, real-time data, we can quickly identify and resolve issues, minimizing downtime and ensuring rapid response to disruptions. It has truly revolutionized our risk management process, giving us the clarity and speed needed to protect our operations and maintain compliance.”

Support for Compliance and Simplified Audits

Safeception ensures regulatory compliance by highlighting risks related to meeting licensing prerequisites, helping the bank GRC team maintain business continuity without regulatory incidents. It also streamlines audit processes, saving time and reducing manual effort by 70%.

Strengthened Cybersecurity and Operational Resilience

Safeception reduced cyber threats by 40% through proactive risk management and robust security controls. It also improved operational resilience by minimizing system downtime by 30% and ensuring critical processes remained operational.

Optimized Incident Management and Business Continuity

Centralized incident response improved reaction times by 50%, while historical data analysis enhanced risk mitigation. Simulation capabilities bolstered business continuity planning, safeguarding strategic objectives during disruptions.

The Results

%

Audit Time Savings

%

Compliance Stability

%

Incident Resolution Speed

%

Threat Reduction

More Case Studies

Discover all our case studies by sector here