Case Study

Safeception for DORA compliance in the financial sector

The Digital Operational Resilience Act (DORA) was implemented to improve the operational resilience of financial institutions within the EU, focusing on strengthening their ability to manage ICT risks, ensure business continuity and comply with regulatory standards. Faced with the complexity of managing multiple assets, third-party services and compliance requirements, financial institutions need advanced tools to streamline their governance, risk management and compliance (GRC) activities.

Safeception has developed a comprehensive solution that helps financial institutions tackle these challenges by offering a platform that automates critical processes related to ICT risk management, infrastructure monitoring, and incident reporting—key aspects of DORA compliance.

The challenges facing financial institutions

Financial institutions are responsible for :

- Ensuring that their ICT systems can withstand disruptions.

- Managing complex, interconnected infrastructures, to ensure seamless business continuity.

- Continuously monitor the risk exposure of all corporate projects and assets.

- Report and manage incidents in accordance with strict DORA requirements.

- These tasks often involve tedious, manual processes, leaving room for inefficiencies and gaps in compliance.

How Safeception Addresses These Challenges

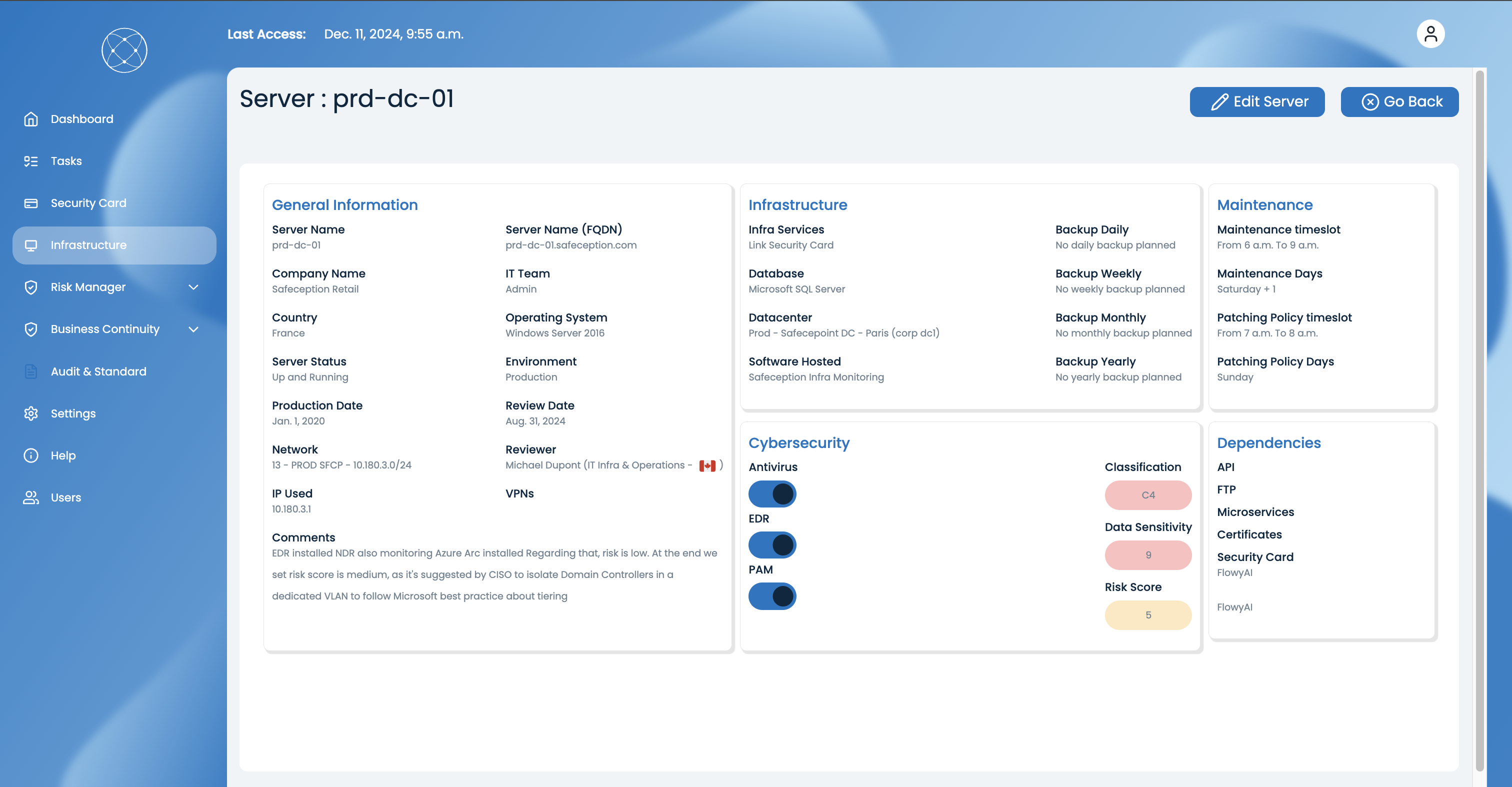

Infrastructure Management for DORA Compliance

Safeception’s Infrastructure Module provides a comprehensive overview of all critical infrastructure elements within an organization. It tracks:

- Servers, FTP systems, VPNs, and other assets.

- Management and update statuses (e.g., OS versions, patches).

- The owners and maintenance schedules for each asset.

This module allows organizations to have a centralized, always-up-to-date record of their infrastructure, ensuring that all assets are compliant with DORA’s resilience standards and properly maintained. This pooling of information offers a considerable operational advantage due to a significant improvement in responsiveness.

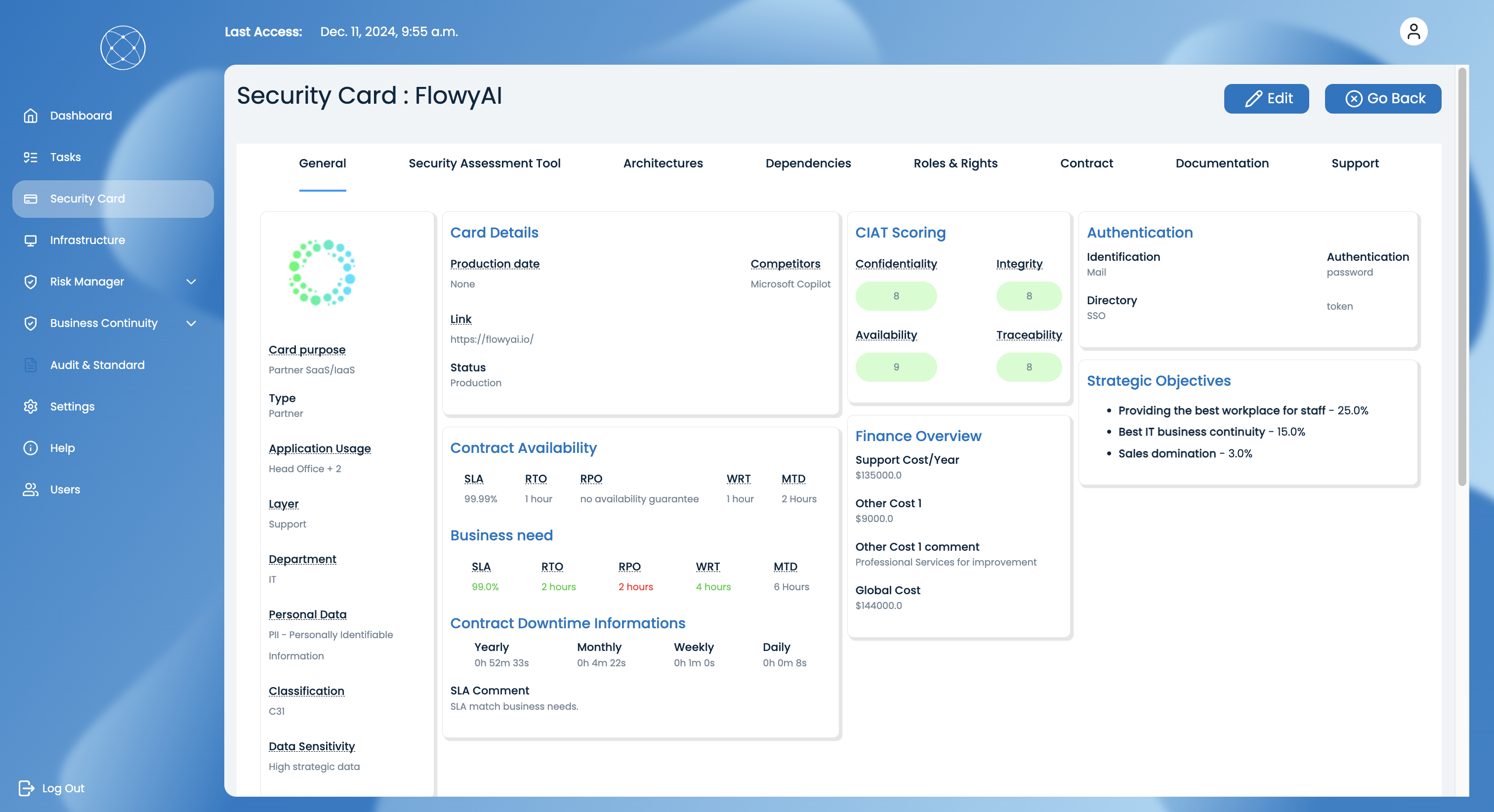

Risk Management Across Projects and Dependencies

Safeception automatically identifies operational risks related to specific projects, assets, and third-party dependencies. Every project and partner is tracked through a Security Card that highlights:

The project’s impact on the organization’s OKRs (objectives and key results).

All project dependencies, including human resources, other projects and infrastructure elements required for project operation.

This visibility enables financial institutions to proactively address risks and make informed resilience planning decisions, ultimately contributing to compliance with DORA operational risk requirements.

Safeception also enables the generation of business continuity plans, highlighting all possible risks associated with a specific project, employee or asset. These plans reinforce the company’s operational resiliency.

Automated Risk Flagging and Reporting

Safeception’s automatic risk flagging functionality highlights operational risks based on regulatory criteria, including DORA. These flagged risks are then sent directly to your analysis team for rapid categorization, evaluation and processing.

In addition, Safeception enables financial institutions to historicize governance tasks and generate compliance reports. These reports can be exported, providing a clear and auditable record of risk management and compliance activities, essential for DORA monitoring.

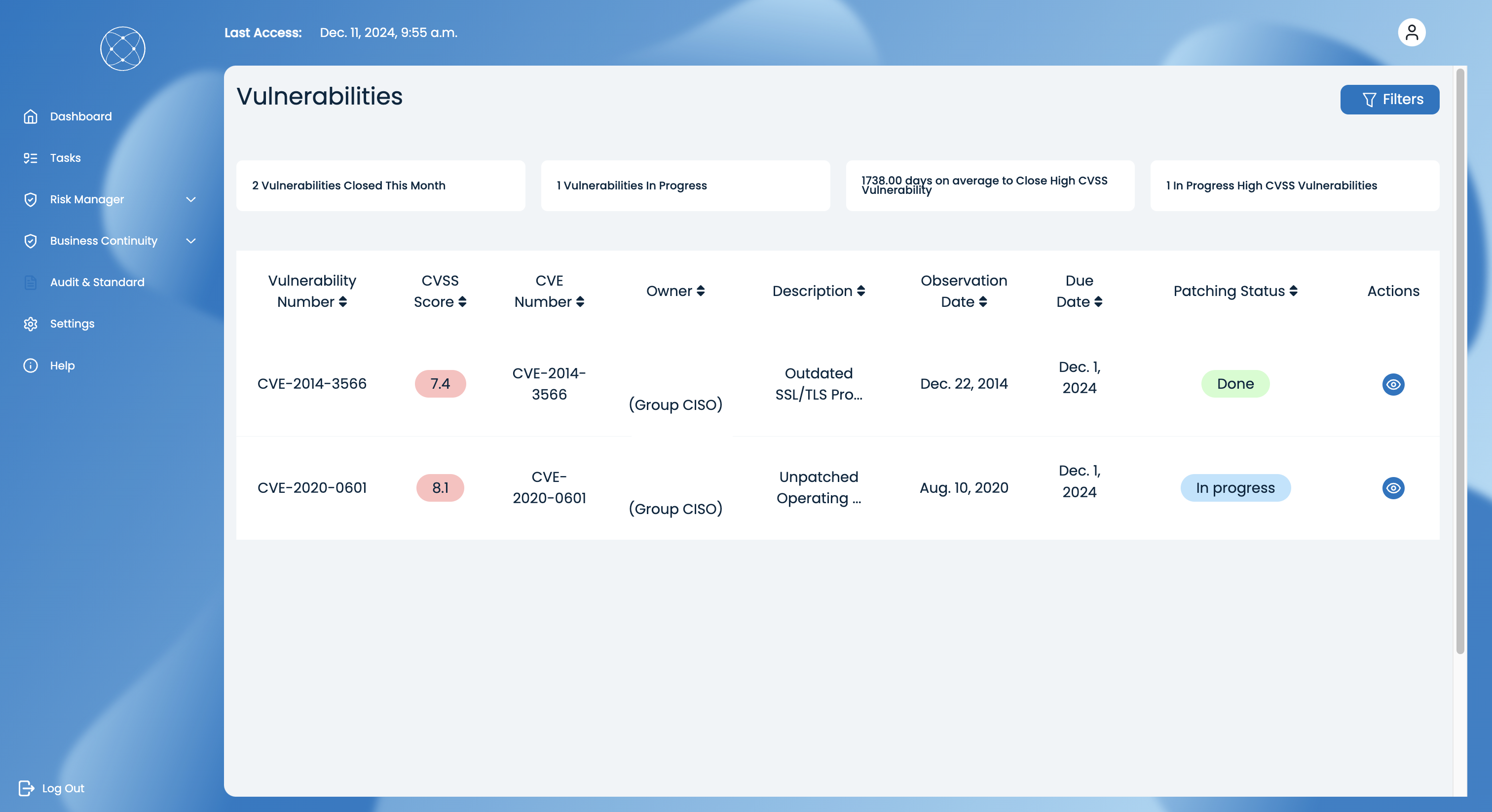

Vulnerability Management and Continuous Monitoring

In line with DORA’s cybersecurity requirements, Safeception offers a vulnerability management module. This tool:

- Continuously monitors emerging public vulnerabilities within the infrastructure.

- Helps organizations maintain a resilient security posture by identifying and vulnerabilities at an early stage.

- Helps meet DORA requirements for continuous monitoring of cyber-risks, reducing the likelihood of incidents affecting business continuity.

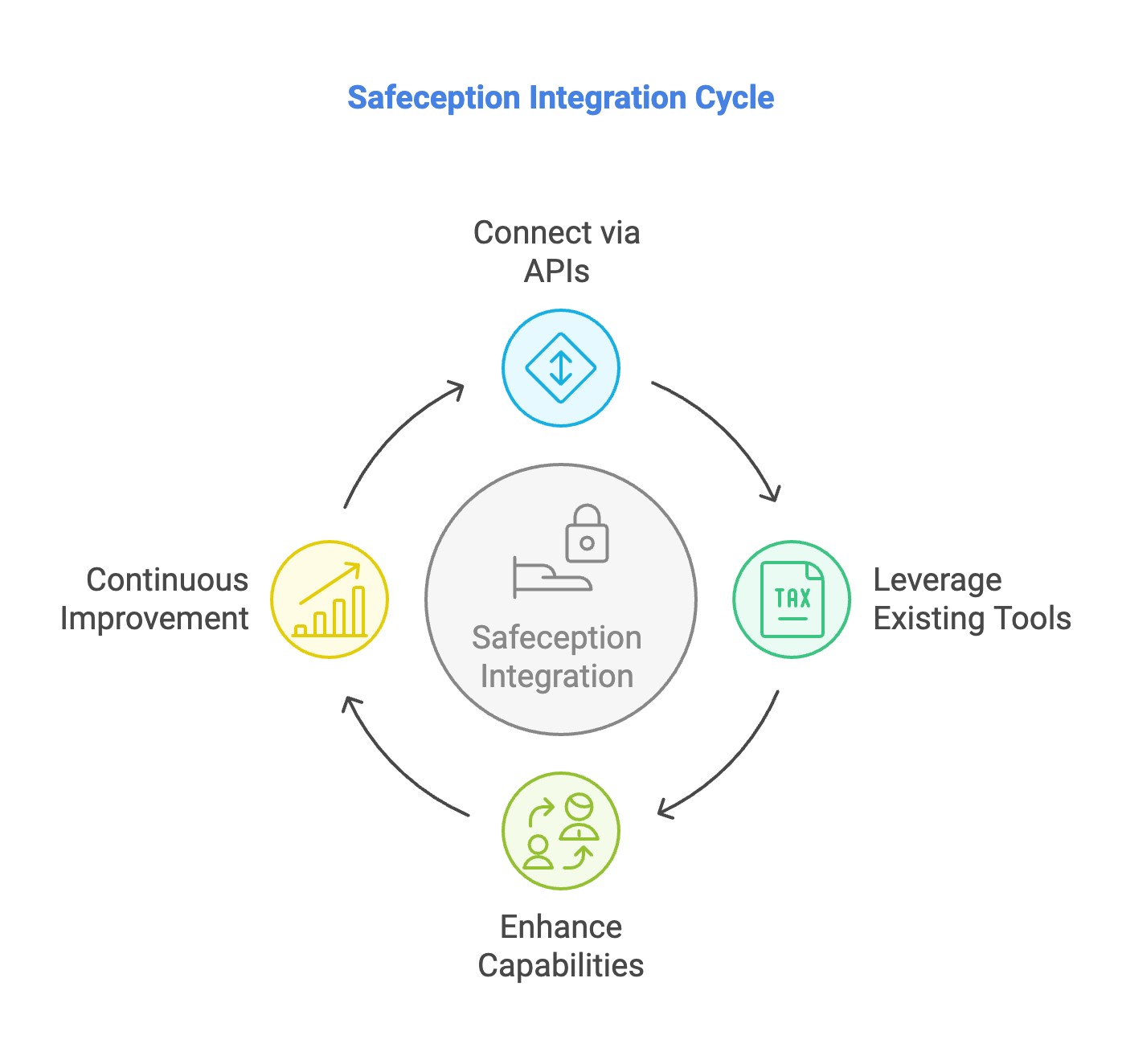

Integration with Existing Systems

Safeception seamlessly integrates with existing IT infrastructure and risk management systems via APIs. This ensures that financial institutions can leverage their current tools while gaining the added benefit of Safeception’s advanced reporting, risk management, and governance capabilities.

By consolidating data and automating risk identification and reporting, Safeception significantly reduces the manual effort involved in maintaining compliance and licenses. Financial institutions can expect time savings of up to 60% on compliance and audit tasks.

“At National Bank, we are a regulated financial institution in Europe and therefore subject to DORA requirements. We have had great difficulty keeping accurate records of our infrastructure, managing third-party risks and reporting on compliance activities.

After implementing Safeception:

National Bank was able to centralize all infrastructure data and maintain real-time visibility into its status.“

Automated risk flagging helped identify several critical operational risks and non conformity point related to third-party dependencies, which were then addressed through targeted resilience measures.

Governance tasks were tracked and reported automatically, significantly reducing the time spent on manual reporting and risk assessments.

Safeception’s vulnerability management capabilities helped the bank proactively address security weaknesses, ensuring continuous compliance with DORA’s cybersecurity provisions.

The Results

%

Audit Time Savings

%

Compliance Stability

%

Incident Resolution Speed

%

Threat Reduction

Safeception provides a robust, intelligent solution for financial institutions seeking to maintain DORA and other standard compliance. By automating infrastructure tracking, non-compliance detection, vulnerability monitoring and governance reporting, Safeception simplifies the process for teams, saves valuable time and ensures that financial institutions adhere to rigorously defined standards.

In short, Safeception’s comprehensive functionality enables you to :

- Manage project and infrastructure operational risks.

- Monitor compliance with evolving regulations.

- Provide real-time information and data for continuous improvement of resilience.

For organizations faced with the complexities of DORA, Safeception is an invaluable tool for implementing a transparent and proactive compliance strategy.